INTEREST RATES

Part 2: What’s Really Driving Our Real Estate Market?

Money has never been cheaper!

We all know that interest rates are at record-low levels, and for many of us in the late boomer cohort we also remember when mortgage rates were close to credit card rates of 15-18%.

In the early 80s, those interest rates drove people to walk into the bank and hand over the keys to their homes. During that period, sellers were known to pay thousands of dollars to buy down the mortgage rate for buyers, pre-paying the interest in order to have a below-market-rate mortgage that would make their home more attractive to buyers. It was such a Buyer’s Market that many homeowners sold their homes and had negative equity, which means they were writing a cheque to bring to the closing table in order to sell their homes.

Today we have the opposite problem. Money is very inexpensive to borrow, and the low rates mean people can afford to borrow more, and demand for housing is so strong that we have the hottest seller’s market in years.

In May of this year, you may recall that CMHC (the Canada Mortgage and Housing Corporation) was predicting that home values would pull back by 15-18%. Their prediction was a result of how quickly the housing market froze with the COVID lockdown in April.

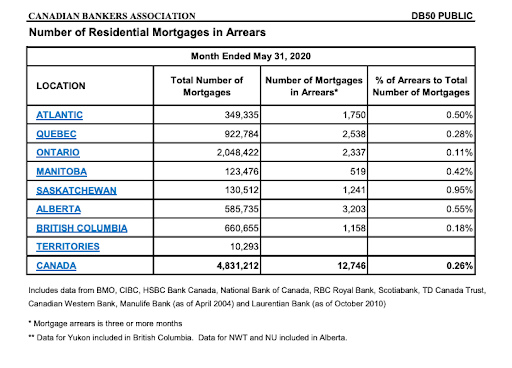

The banks and Federal government quickly implemented a mortgage deferral program that allowed roughly 760,000 Canadians to defer some or all of their mortgage payments for a 4-6 month period. According to the CMHC and the Canadian Bankers Association, this means that roughly 1 out of 6 people with a mortgage took advantage of some form of deferral, which amounts to roughly $1 Billion per month in payments deferred.

The arrangements with the banks that allowed people to defer up to 6 months of payments are the biggest reason why the actual default rate on mortgages is currently at 0.28% with the 5 major banks.

Here’s where it gets interesting.

Numerous studies have shown that the average person (investor) will typically hold onto assets as they rise in price. People don’t want to let go “too early” and will often try to time the market. In most cases, those trying to time the market will hold on too long and will lose value before they finally sell.

Housing is no different. I’ve witnessed this behaviour many times over the past 30 years, and we’re seeing examples of it today as many people hold off because they expect the market to keep going up.

There’s only one reason why someone defaults on a mortgage. Ultimately, they can’t pay their bills and eventually stop paying the mortgage, and quickly lose control of the situation to the point where the lender steps in and takes the house.

The last major recession saw a quick drop in prices that left a lot of people upside down, owing more than the house was worth. The market quickly lost momentum and it took several years to regain stability and clear the inventory.

The difference between then and now is that we’ve tightened up mortgage qualifications, and overall it has been tougher to qualify for mortgages.

The risk however is still there. How many of those 760,000 mortgages have not restarted payments? How many of those homeowners are holding out for higher prices, or a job restarting or a new job surfacing before they realize the hole that has been dug is now too deep?

The latest report from the Canadian Bankers Association was released this past week. It shows that in Ontario, there are just over 2,000,000 mortgages and as of the end of May 2020, 2,337 of those mortgages (0.11%) were in actual arrears – which is over 3 months behind in payments. Ontario, at 0.11% in arrears, is better than the Canadian average of 0.26%. We’re also the province with the second highest cases of COVID and an economy that is 77.9% driven by the service sector.

This pandemic has affected the service sector far more severely than the manufacturing sector. How many of the 2,000,000 mortgages in Ontario are being paid by people employed in the service sector, and are running out of deferral runway and will soon be 3+ months behind in payments?

Could the CMHC prediction of the real estate market dropping by 18% eventually play out?

This chart shows how the current level of sales is significantly above the 5 year average number of sales. Notice the period of March through May where sales bottomed out because of the lockdown. We would need a sudden influx of new listings, combined with a sudden drop in demand (perhaps another lockdown, or the economic recovery slows again) to see prices start to drop significantly.

If the default rate on mortgages made it to 2%, that would be 40,000 homes in Ontario coming into the market. The five year average high for new listings across Canada is just under 1,800 listings per day. The theory is that if 40,000 properties were introduced to the market in a relatively short period of time, current demand would absorb a portion, but within a number of weeks or months the market would become saturated with houses that need to be sold. No question this will have a negative impact on pricing.

If I was struggling to pay a mortgage today because of being out of work, or on reduced hours and pay, do I make the wise move and sell before everyone else in the same situation, or do I follow the average and still try to time the market and hold on?

In the age of the internet, we’ve seen how quickly markets react and change. I believe that the real estate market will react to subtle market forces faster than we will be able to acknowledge. The next 6-12 months that it will take to get vaccines out and to work through this COVID wave and the next will define our real estate market for the next 5 years.

Where does this next roll of the dice take us? Stay tuned.

THE PAST WEEK IN THE GUELPH REAL ESTATE MARKET

Last week, the median home sold in Guelph looked like this: 3 bed, 2 bath, 1,600 sqft. It sold in 14 days, for $633,000 – that’s $409/sqft. 33 of the 43 homes sold this week went at or above list price, with a median sales to list price ratio of 101.3%. Same week last year, the median home was 3 beds, 2 baths and 1,347 sqft. This home sold in 22 days for $518,000, or $367/sqft. Of the 45 homes sold in the same week last year, only 14 sold at or above list.

Enjoy the weekend and thank you for being a subscriber. Join us again next Friday for Part 3: Immigration and the impact on our local real estate market.

FEATURED PROPERTY:

20 EDWIN STREET

GUELPH, ON

4 BED / 3 BATH / 2,107 SQ FT

A home with a legacy – this 1880s red brick unfolds into a masterpiece of Old World charm and modern warmth. With a true chef’s kitchen, beautifully preserved original finishes, and a private courtyard, you’ll feel whisked away to a European dream in your everyday life. This is the one you got to see!

Irene Szabo (519) 830-5497

Learn more about the Home Group Realty Journey

SIGN UP FOR SALES REPORTS

Not a subscriber? Sign up for our weekly blog and receive up-to-date information on local market conditions, plus receive exclusive reports with each week’s homes sales & sales price, for all of Guelph’s neighbourhoods and nearby cities